China's export-dependent solar panel makers are seeing a glimmer of light at the end of the tunnel

China’s export-dependent solar panel makers are seeing a glimmer of light at the end of the tunnel after a difficult year fighting a global credit squeeze and a spate of project delays, a senior industry executive said.

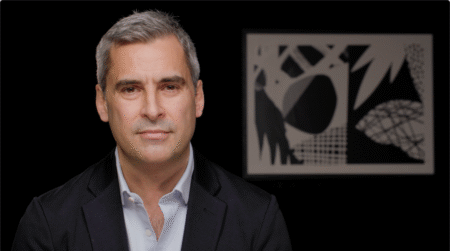

Major markets in Europe and the United States are slowly recovering, Terry Wang, the chief financial officer of U.S.-listed Trina Solar, said at the Reuters Global Climate and Alternative Energy Summit in Beijing.

“The worst is already over, and the whole sector in the United States and China can wake up in the fourth quarter, but a full recovery is likely to have to wait until the second quarter of next year,” Wang said.

Trina has successfully navigated a 50-percent collapse in solar panel prices this year, helped by significantly lower polysilicon raw material costs, and was well placed to exploit strong underlying demand in the global market, he added.

“Affected by the financial crisis this year, our shipment volume has still increased, and our profitability has been maintained and increased compared to last year despite such a rapid drop in prices — that’s not easy,” he said.

Trina Solar, founded in 1997 and based in the city of Changzhou in the Yangtze river delta, earned $0.71 per share in the second quarter, up 4 percent from a year earlier and well ahead of analysts’ expectations.

Wang said the company was on course to meet its shipment targets for this year and planned to raise production capacity to between 850 and 950 megawatts by the end of next year, from 400 MW now.

With foreign export markets in the doldrums, China’s policy makers have wrestled with the problem of stimulating demand at home, and a new subsidy regime allowing solar power projects to compete with thermal plants is now being put in place.

But with the domestic market still in its youthful early stages, China’s photovoltaic panel sector is more vulnerable than most to changes in external demand. Around 95 percent of Trina Solar’s customers are based overseas, Wang said.

Europe remains the major battleground for Chinese solar manufacturers, and although installations in China and elsewhere are expected to surge in the coming years, around 80 percent of demand will still be in Europe next year, he said.

China’s solar sector is therefore vulnerable to policy adjustments abroad, and suffered last year when the Spanish government decided to curb subsidies for photovoltaic projects.

It is also vulnerable to economic downturns, and last year’s financial crisis quickly forced developers to delay project construction plans, reducing demand and driving solar component prices through the floor.

The problems were only temporary, Wang said.

Global solar module demand is still expected to grow by as much as 76 percent next year, reaching 10.5 gigawatts, according to a research report by UBS.

Trina Solar itself forecasts output growth of 80-90 percent next year from 350-400 megawatts this year.

Despite intensifying competition, Trina aims to raise its share of global panel shipments, worth around $16 billion in 2008, to 8 percent, from 5 percent now, Wang said.

“We want to expand faster than the overall market and boost our market share. We only need demand and we will adjust our expansion plans. We will not expand blindly.”