East Campus project, which is expected to add approximately 500 MW of cell and module capacity and feature its high-efficiency Honey cell technology.

CHANGZHOU, China, Feb. 16, 2012 /PRNewswire-Asia/ — Trina Solar Limited (NYSE: TSL) (“Trina Solar” or the “Company”), a leading integrated manufacturer of solar photovoltaic products, announced today that its wholly-owned subsidiary, Trina Solar (Changzhou) Science & Technology Co. Ltd., has obtained a three-year structured term loan facility from Standard Chartered Bank.

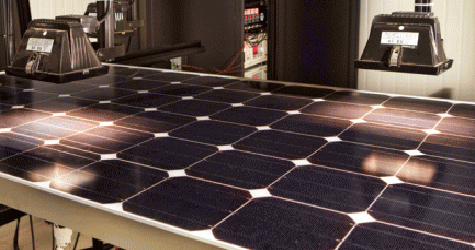

The structured term loan facility is for an amount of up to US$100 million dollars, which may be drawn down in single or multiple tranches within the first 12 months. Each tranche is for a term of up to 36 months from the initial drawdown date, and may be extended for up to another two years. The facility will support the Company’s announced East Campus project, which is expected to add approximately 500 MW of cell and module capacity and feature its high-efficiency Honey cell technology.

“We are very pleased to have received this financing to drive the commercial realization of our innovative technology,” said Terry Wang, Chief Financial Officer of Trina Solar. “We recognize Standard Chartered Bank’s consistent and strong support of solar energy’s adoption through its renewable energy financing initiatives, including providing this loan to support the rollout of our new high-efficiency product.”

Eric Lian, Managing Director and Head of Wholesale Banking Origination & Client Coverage, Co-Head of Wholesale Banking, Standard Chartered Bank (China) Limited, said, “We are very pleased to provide financial support to Trina Solar, a leading integrated manufacturer of solar photovoltaic products. Standard Chartered is a firm supporter of renewable energy. We have integrated environmental and sustainable development criteria into our lending and investment decision making processes, and established deep relationships with many clients in the clean energy sector. Leveraging on our global expertise in sustainable business, we are committed to developing financial products and services for Chinese corporates in the clean energy industry to facilitate a shift to a low-carbon economy in China.”

In addition to this term loan, Standard Chartered Bank has worked closely with Trina Solar since 2008, providing short-term working capital and trade financing facilities, as well as products that support the Company’s foreign exchange hedging program.

About Trina Solar Limited

Trina Solar Limited (NYSE: TSL) is a leading manufacturer of high quality modules and has a long history as a solar PV pioneer since it was founded in 1997 as a system installation company. Trina Solar is one of the few PV manufacturers to have developed a vertically integrated business model that extends from the production of monocrystalline and multicrystalline silicon ingots, wafers and cells to the assembly of high quality modules. Trina Solar‘s products provide reliable and environmentally-friendly electric power for a growing variety of end-user applications worldwide. For further information, please visit Trina Solar‘s website at http://www.trinasolar.com.

Standard Chartered – leading the way in Asia, Africa and the Middle East

Standard Chartered is a leading international banking group. It has operated for over 150 years in some of the world’s most dynamic markets and earns around 90 per cent of its income and profits in Asia, Africa and the Middle East. This geographic focus and commitment to developing deep relationships with clients and customers has driven the Bank’s growth in recent years. Standard Chartered PLC is listed on the London, Hong Kong stock exchanges as well as the Bombay and National Stock Exchanges in India.

With 1,700 offices in 70 markets, the Group offers exciting and challenging international career opportunities for its 85,000 staff. It is committed to building a sustainable business over the long term and is trusted worldwide for upholding high standards of corporate governance, social responsibility, environmental protection and employee diversity. Standard Chartered’s heritage and values are expressed in its brand promise, ‘Here for good’.

In China, the Bank set up its first branch in Shanghai in 1858 and has remained in operation throughout the past 150 years. Standard Chartered Bank (China) Limited is one of the first foreign banks to locally incorporate in China in April 2007. This demonstrates the Bank’s commitment to the China market, and its leading position as a foreign bank in the banking industry. Standard Chartered has one of the largest foreign bank networks in China – with 20 branches, 61 sub-branches and 1 Village Bank. Approvals for the setting up of the Jinan branch and Changsha branch have been granted and preparations are in progress.

In 2011, Standard Chartered China received many awards and honors, including “Outstanding Contribution Award” from China Bank Association Foreign Bank Working Committee, “CSR Award 2011” from China Business News, “Best Case Study Award 2011” from 21st Century Business Herald, “Best RMB Cross-Border Settlement Bank” from Sinotf.com and Trade Finance, “Prominent Competence Bank on SME Service Award” from China Business and “2011 Most Respected Bank & Best Retail Bank Award” from Money Week.

For more information on Standard Chartered, please log on to www.standardchartered.com.

Safe Harbor Statement

This announcement contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact in this announcement are forward-looking statements, including but not limited to, the Company’s ability to raise additional capital to finance the Company’s activities; the effectiveness, profitability and marketability of its products; the future trading of the securities of the Company; the Company’s ability to operate as a public company; the period of time for which the Company’s current liquidity will enable the Company to fund its operations; general economic and business conditions; demand in various markets for solar products; the volatility of the Company’s operating results and financial condition; the Company’s ability to attract or retain qualified senior management personnel and research and development staff; and other risks detailed in the Company’s filings with the Securities and Exchange Commission. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations, assumptions, estimates and projections about the Company and the industry in which the Company operates. The Company undertakes no obligation to update forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results.