Connacher Oil and Gas Limited (CLL – TSX) announced today that it has successfully completed its annual turnaround

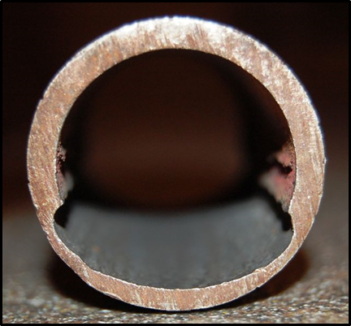

Connacher Oil and Gas Limited (CLL – TSX) announced today that it has successfully completed its annual turnaround at its 10,000 barrel per day (“bbl/d”) Great Divide Pod One (“Pod One”) steam assisted gravity drainage (“SAGD”) oil sands plant in northeastern Alberta. The company is in the process of restoring normal operations and again ramping up its bitumen production, which had exceeded 8,000 bbl/d prior to the turnaround. The Pod One plant, steam generation and injection, wells and production were down for a period of four days during the turnaround. All vessels and treater systems were inspected and cleaned out and routine maintenance was conducted. The company also took the opportunity during the turnaround to conduct a number of SAGD well workovers. This work included the installation of one additional electric submersible pump (“ESP”) and workovers on five wells in the north pad, all part of the company’s optimization program aimed at reducing steam:oil ratios (SORs), maximizing steam injection to specific wells and the location of steam in the wellbore, while increasing production in the affected wells. The company now has ESPs in six SAGD wells.

Production is now underway at 15 of the 17 SAGD well pairs at Pod One, including production from the company’s two most recent SAGD wells, which were converted from steam injection in July of this year and which are still in the early stages of their ramp-up. It takes several days after reactivation to achieve targeted production levels from all wells and once steady state production operations have been achieved, we will report an update on bitumen production at Pod One.

The company anticipates installing two to three new generation high temperature ESPs later this year which should result in longer pump run lives while allowing higher production volumes and reduced SORs. The high temperature ESPs represent an evolution of ESP technology that has better applicability to Connacher’s reservoir. Connacher is pleased to announce that it will be among the first oil sands producing companies to use these new ESPs in commercial operations. It is anticipated bitumen production levels will ramp up to near-design capacity in the fourth quarter of 2009 and 2010 daily average bitumen production is anticipated to be approximately 9,500 bbl/d.

Construction activities at Connacher’s second 10,000 bbl/d SAGD facility (“Algar”) in the Great Divide region of northeastern Alberta are progressing with excellent results. Field construction at the Algar plant site resumed on July 7, 2009. At the time construction reactivation occurred, Connacher had estimated a remaining cost of $200 million to complete the project, excluding contingencies of $15 million. With the recent cancellation and deferral of a number of oil sands projects in the Fort McMurray region, the actual costs for labor, services and equipment may end up being lower than the cost estimates used in the Algar reactivation budget, providing a built-in contingency.

We anticipated that completion of construction activities at Algar and the drilling of the associated 17 SAGD well pairs would take approximately 275 days from the reinstatement of construction. It appears that today we are modestly ahead of this schedule, without taking into account approximately five days lost due to inclement weather. Construction activities have benefitted from generally positive weather conditions since the re-commencement of the Algar project in July 2009. Drilling activity has proceeded in a very efficient manner, with improved engineering processes and technology, supported by the availability of superior hardware and crews compared to our experience at Pod One.

Once plant construction and drilling and tie-in of the SAGD wells is complete at Algar, anticipated for April 2010, a 30-day commissioning of the SAGD facility is anticipated. This will be followed by a 90-day steam circulation phase for the SAGD well pairs, prior to commencement of SAGD production and ramp-up towards rated plant capacity of 10,000 bbl/d, by the end of 2010 or early 2011. Connacher posts weekly pictorial progress reports about the Algar project on its website at www.connacheroil.com, including pictures of construction activities and a construction countdown clock.

Our scheduled turnaround at our Great Falls, Montana refinery is also proceeding favorably with regard to timetable and budget, with the restoration of full throughput anticipated for mid-October 2009. In the meantime, asphalt sales are proceeding favorably at attractive prices. Efforts are underway to capitalize on this strong asphalt market before the normal seasonal slowdown, when we will further reduce inventories consistent with the restoration of normal refinery throughput.

Assuming no unusual collapse in crude oil prices such as occurred in 2008, Connacher anticipates that the combination of cash ($401 million cash on hand as at June 30, 2009) and future cash flow from operations, before non-cash working capital adjustments (“cash flow”), during the second half of 2009 and during fiscal 2010 will be sufficient to fully fund completion of the Algar project, fund our conventional and refining capital activities in 2009 and 2010, fund the construction of an estimated $27 million cogeneration facility at Algar, fund an estimated $10 million dilbit sales transfer line between Algar and Pod One and service our indebtedness through 2010. Our remaining cash balances and future cash flow, including production from both Pod One and Algar and funds from our conventional and refining operations, would then be available to service debt and to partially fund our growth expenditures during the 2011-2015 period, as we move towards achievement of our goal of surpassing 50,000 bbl/d of bitumen production in 2015. The company is presently evaluating a new round of core hole drilling on its existing acreage, aimed at further expanding its bitumen reserve and resource base. We also plan to evaluate some modest additional conventional exploration activity on its existing lands in northern Alberta.

Connacher Oil and Gas Limited is a Calgary-based integrated oil company. Its primary upstream production is from oil sands operations at its 10,000 bbl/d Pod One SAGD plant in northeastern Alberta. The company has reactivated its construction activities and has fully funded a second similar-sized SAGD oil sands project in Great Divide at Algar. It has conventional crude oil and natural gas production of approximately 3,100 boe/d in Alberta and Saskatchewan, a downstream operation with a 9,500 bbl/d heavy oil refinery in Great Falls, Montana and maintains a 22 percent equity stake in Petrolifera Petroleum Limited (PDP-TSX), a production and exploration company active in Argentina, Colombia and Peru in South America.

Forward-Looking Information

This news release contains certain “forward-looking information” within the meaning of applicable securities laws including the company’s planned installation of new high temperature ESPs later this year and the anticipated results therefrom, anticipated bitumen production levels and the timing associated therewith, estimated costs to complete the construction of Algar and the timing associated with completion of construction, commissioning and steam circulation prior to commencement of SAGD production and commercial production at Algar, the timing of restoration of full throughput and inventory reductions at the company’s refinery and the sources of funding in respect of capital expenditures and debt servicing obligations through 2010 and the evaluation of additional core hole drilling and conventional exploration activity. Actual capital costs will differ from estimates of capital costs contained in this news release and such differences may be material. Estimated capital costs are based on historical experience in constructing Connacher’s first SAGD project at Great Divide and have been adjusted for inflation, actual expenditures incurred to date and existing contractual commitments. However, costs for labour, services and equipment have been declining due to the current economic conditions and cost savings could be realized if Connacher is able to capitalize on these opportunities without adversely affecting the timing for completion of Algar. Additionally, future cash flow is dependent on actual results of operations which are subject to a number of risks and uncertainties and may differ from current expectations. Forward-looking information is based on the opinions and estimates of management at the date the information is provided and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. These risks include, but are not limited to risk associated with the oil and gas industry (e.g. operational risks in development, exploration and production delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections in relation to production, costs and expenses and health, safety and environmental risks), the risk of commodity price and foreign exchange rate fluctuations, risks associated with obtaining, maintaining and the timing of receipt of regulatory approvals, permits and licenses, uncertainties relating to access to capital and credit markets and the risk of continuing deterioration of global economic conditions. In certain circumstances Connacher may curtail production, defer expenditures and/or modify its plans with respect to capital expenditures, which may impact year-end cash balances and net operating income. Additional risks and uncertainties are described in the Corporation’s Annual Information Form which is filed on SEDAR at www.sedar.com.

Cash flow does not have a standardized meaning prescribed by Canadian generally accepted accounting principles (“GAAP”) and therefore may not be comparable to similar measures used by other companies. Cash flow is calculated before changes in non- cash working capital, pension funding and site restoration expenditures. The most comparable measure calculated in accordance with GAAP would be net earnings. When disclosed, cash flow is reconciled with net earnings.