Over the last decade, the cost of solar generation hardware has dropped by nearly a third

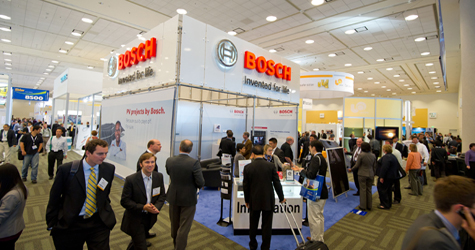

As the solar industry readies itself for this week’s Solar Power International conference in Anaheim, Calif., we thought we’d take a look at the roller-coaster financials many of the companies have seen in the past year. First, there is one overriding trend: Over the last decade, the cost of solar generation hardware has dropped by nearly a third.

In large part, this change can be attributed to cheaper labor costs as more contractors learned faster, more efficient installation techniques. As startup loans paid themselves back and solar gained some traction, marketing and overhead also decreased. The real kicker, though, came last year when prices dropped a record 4 percent. This happened because increasing production capacity and decreased costs collided with a crashing economy and its accompanying depressed demand.

This decrease in costs largely nullified inflation as far as purchase cost is concerned. According to research conducted by several industry watchdogs, the cost of installed photovoltaic systems went from $10.80 per watt in 1998 to $7.50 per watt in 2008.

Unfortunately, at the same time manufacturing and installation costs were dropping, so were government incentives. In the end, it cost a consumer more to install a photovoltaic system in 2008 than it would have ten years earlier. It is also worth noting that solar was much cheaper per-watt in sunny areas like Arizona and more expensive in cloudy regions like Pennsylvania.

Prices for solar hardware are expected to decline further as innovative new manufacturing processes begin to take hold. One prominent example is Skyline Solar, which has substantially cut its up-front costs relating to manufacturing by utilizing existing assembly facilities. Skyline has successfully “cut out a corner” of an existing facility in Troy, Mich., conveniently owned and operated by Cosma International, a subsidiary of Magna International, which is known for manufacturing auto components for Toyota, Mercedes and Ford among others.

By using existing metal-stamping facilities to press the forms for their new line of high-gain solar panels, and using fewer expensive materials, Skyline Solar is able to do what many other solar companies do on the cheap.

But Skyline hasn’t just found ways to produce their cost-efficient panels — they install and maintain the panels they turn out as well. Modular in construction and compatible with pre-engineered racks and tracking hardware, Skyline Solar’s panels are easier to install in most situations than application-tailored systems.

Skyline’s first components have already been built at its Troy plant, but operations are expected to move to a larger facility by 2010. All of its tactics and cost-savings must continue in order for it to compete with Chinese companies — the other major force driving down prices for solar equipment. Utilizing cheap labor and manufacturing facilities in a relatively regulation-free environment, solar companies based in China have already plunged the cost of panels it exports to the U.S.

China’s ENN is now partnering with Duke Energy, based in Charlotte, N.C., to build thin-film solar production facilities on U.S. soil. Though they are focusing mostly on industrial and utility-scale solar installations rather than residential or small commercial, the partnership has serious promise. Duke has expertise in navigating regulations in the U.S., and ENN has become a lean machine when it comes to constructing solar farms, quickly and inexpensively. The joint venture is likely to capture substantial market share.

So what’s ahead for 2010? Costs are likely to continue to drop as innovations in manufacturing and materials science continue to roll out. Chinese import solar panels are also unlikely to be deterred by proposed carbon tariffs pending congressional approval in the U.S. What’s more, proposed legislation that would establish a cap-and-trade system in the U.S. would provide even more of an economic incentive for solar power development, whether it comes from China or not.