Ageing wind assets, growing corporate demand and limited appetite for full repowering are favoring lifetime extension projects, increasing the importance of performance analysis.

European lifetime extension (LTE) activity is set to hike in the coming years as feed-in tariffs expire and wind operators seek to maximize revenues from ageing assets.

Around 4 GW/year of European wind turbine capacity could be ripe for LTE in the period 2019-2028, Wood Mackenzie Power and Renewables said in a report published last month.

Some 65 GW of European wind capacity will reach end of 20-year design life by 2028 and 42 GW could represent commercially-viable LTE projects, the research group said. Around half of this identified capacity is located on small wind farms or distributed sites, where larger repowering projects are uneconomical, it said.

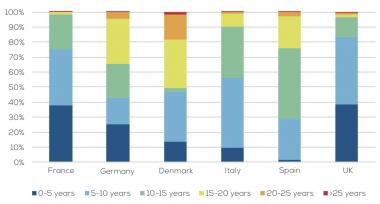

Wind turbine ages by country

(Click image to enlarge)

Source: WindEurope, August 2018.

Repowering of assets with larger, higher efficiency turbines offers the greatest revenue potential, but projects require permitting approvals and spending requirements often outweigh the potential market returns.

As a result, most operators are expected to favour LTE projects in the short to medium term.

“Up to 22 GW of onshore wind turbines in Europe will reach the end of the original design life by 2023, of which 2 to 4 GW will be repowered, and up to 18 GW of units’ life will be extended,” Uli Suedhoff, Director Business Development, EMEA at turbine supplier GE Renewable Energy, told New Energy Update.

LTE durations vary and spending depends on a range of technology and market specific factors. Wider market forces could also impact LTE activity in the coming years as corporate demand for renewable energy grows and national governments implement European Union (EU) legislation.

EU aid

Turbine advancements have boosted the case for full repowering but projects remain hampered by regulatory hurdles and power market risks.

Environmental regulations are stricter than when the turbines were originally installed and repowering projects typically gain no price support.

To aid the sector, the European Commission (EC) has implemented new legislation to support repowering and life extensions, but this is yet to filter into national market frameworks.

Renewable Energy Directive II and governance regulation, due to be effective from 2021, requires EU member states to implement streamlined procedures for permitting and grid connection for repowering projects, and include repowering in National Energy & Climate Plans (NECPs). Italy is currently the only country with support measures in place for both repowering and LTE projects.

“To date…little is reflected in the submitted 2030 National Energy & Climate Plans (NECPs),” Suedhoff said. “In fact, only five EU member states mentioned repowering or life extension at all,” he said.

“More needs to be done on an EU and member state level to address regulatory uncertainty and to support wind turbine operators in their decisions,” Suedhoff said.

Corporate demand

As wind subsidies expire, growing corporate demand for renewable energy is helping to support the business case for LTE projects.

Last December, Mercedes-Benz Cars signed Germany’s first corporate renewable power purchase agreement (PPA) with power group Statkraft in a deal which will extend the lifespan of six ageing wind farms commissioned in 1999-2001.

From 2021 to 2025, Mercedes-Benz will source 46 MW from the six wind farms located in northern Germany.

GE will perform lifetime extension work and is the contracted operations and maintenance (O&M) provider for all six wind farms under a five-year contract. The wind farms use turbines from a range of manufacturers, creating additional monitoring and service challenges.

Turbines in the Mercedes-Benz contract

Source: Statkraft

The wind PPA will provide stable asset revenues as feed-in tariffs expire and the turbines move beyond 20 year lifespans. Some 33.1 GWh will be delivered in 2021, 74 GWh in 2022-2024 and 21.8 GWh in 2025. Each asset will deliver power for between three and five years, depending on feed-in tariff expiry date.

Statkraft will take on the commercial risk of the PPA and the power sourced from the contract will be integrated into an existing power contract between Mercedes-Benz owner Daimler and energy supplier Enovos Energie Deutschland.

The PPA shows large corporations, power traders and wind maintenance groups can find risk comfort in shorter power contracts for ageing assets and more LTE deals are expected in the coming years.

In Germany alone, up to 4 GW of installed turbines will exit Germany’s feed in tariff scheme at the end of 2020, Suedhoff told New Energy Update. By 2026, some 16 GW of German wind capacity will be subsidy-free, data from WindEurope shows.

Enovos has already indicated it will seek similar deals.

“Integrating the renewable energies that are not subsidized by [Germany’s feed in tariffs] into traditional energy delivery models will be of key importance for our target market of major industrial companies in the future,” Andreas Loh, Managing Director of Enovos, said.

Critical data

The length of the LTE and spending requirements depends on a range of technology and market-specific factors.

In Spain, Siemens Gamesa signed a contract to extend the lifespan of 238 MW of wind capacity from 20 years to 30 years.

The LTE program consists of monitoring and structural upgrades at 264 wind turbines owned by an unnamed Spanish company. The turbines are situated at six wind farms in the provinces of Zaragoza and Teruel and have an average age of 15 years.

Operators face the challenge of assessing the potential technical lifespan of their assets, despite limited historic data in this area.

Operators must weigh growing component failure risks and insurance premiums against potential merchant power revenues, Daniel Liu, Principal Analyst for Wind Power Operations and Maintenance at WoodMac, said in a note last month.

“Capital component failures remain the biggest operational risk and can be costly enough to eliminate the economic impact of running lifetime extended assets. Supply of spare parts may also be a concern for less popular technologies or from defunct [original equipment manufacturers],” Liu said.

Data from turbine suppliers remains critical to end-of-life decisions and advances in analytics and predictive maintenance are helping to improve performance forecasting.

Siemens Gamesa is developing software that collects real-time data on “fatigue accumulation” to minimize faults and improve end-of-life decisions, the company told New Energy Update in January.

“What is key for life extension is to ensure a common understanding of ageing mechanisms, so manufacturers can provide common certifications and guarantee to local authorities and owners that operating a wind turbine far beyond their original design life is totally safe,” Siemens Gamesa said.

By Ed Pearcey – NEW ENERGY UPDATE